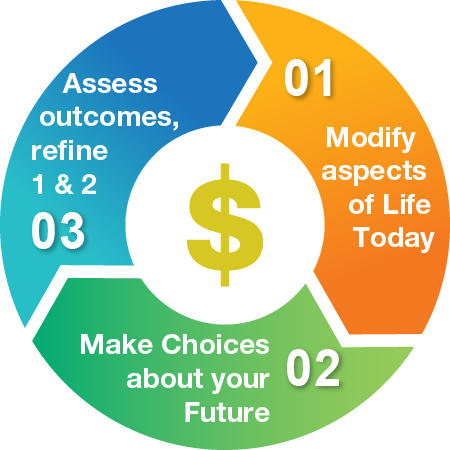

It all starts with Life Today

Your current situation is the foundation of your plan. Our tools

make it easy for you to describe where you are.

make it easy for you to describe where you are.

It starts with you desribing what you own. If we were to use jargon, these would be called fixed assets. Really it is simply things you own. This is also where we capture operating costs for things like homes and cars.

The financial side of what you own. This is where you can add your RSPs, TFSAs, RESPs and any other financial savings accounts you hold. These are your financial assets. If you currently make regular savings contributions, they are captured here.

Your liabilities are what you owe. Enter your mortgages, line of credit, or other loans here. If the debt is secured by an asset it can be linked and any outstanding balance paid when you sell the asset.

Incomes capture the new money (excluding the earnings inside your savings accounts) that enters your life. Simply enter the pre-tax amounts you receive, and we will add it to your cash flows and take care of tax calculations.

Expenses capture where you regularly spend in a repeating fashion, (groceries, cell phones, childcare, etc.) During sign up we will help you establish a baseline from which your can refine.

From there you can make Future Choices

Future Choices is all about what you want life

to look like going forward from today.

to look like going forward from today.

Your "Life Today" carries forward to the future. Edit them under Future Choices to set a retirement date, buy/sell a property, start or stop and expense, etc.

Vacations are captured as part of Future Choices. For some years, simply budgeting an amount is enough. Other years however, might be more expensive. Taking that bucket list trip will likely exceed your standard budget. Best of all, simply by documenting your desire, you are more likely to make it happen.

Large renovations may be infrequent, but they can be expensive. Link your renovations to your property and, like debts they will disappear if you decide to sell before the renovation was scheduled. Don't forget a roof last's 20-25 years, afurnace 15 years, and downsizing may require you to buy new furniture and/or appliances.

The "Other" category is for everything else. Add a child's educational expenses here - these can be linked to RESP accounts. This section also covers tax deductible donations (so we can give you the tax credit) and any other large future expenses that doesn't fit will anywhere else like big celebrations, large gifts, or weddings.

The payoff is your Choice Assessment

At any time, use Choice Assessment to

understand where your choices are leading.

understand where your choices are leading.

Choice Assessment starts with a quick evaluation of where your choices are leading over the balance of the life of you and your partner. Green - Life is good and your plans works. Yellow - Your plans work but there is one or more years where cash may be tight. Red - Your plans as they stand will leave you with one or more years where expenses are greater than your available cash.

Net Worth is everything you own (savings, property, cash/surplus) less the total of what you owe (debt and cash deficits). The interactive chart allows you to click on any year to see your total net worth or to click on an asset class to see how it is changing over time.

Every choice you make engages your available resources, be it time, energy, money or all three. The Choices report will show you how your activities balance out over time. When you start out, this chart will look like a straight line, as you continue to engage you will find peaks and valleys developing.

The Sources & Demands report will provide you with an understanding of where your cash is coming from and going too. Demands are "actual" as opposed to your intentions, savings goals will only be achieved to the degree you can support them, and taxes paid reflect taxes paid (not to be confused with taxes owing) in the year from free cash flow. Just like real life, some of your taxes might be paid in the next year. Download the excel report for more details.

The Balance Sheet report gives you a numerical equivalent of the Net Worth report. Exportable to excel, the data provides you with a reflection of how you what you own and own changes overtime. If you have a plan that you are happy with, the most important numbers are in the first 3 - 5 years. The nature of long-term plans is that the real-world accuracy degrades the further forward the projection. Your focus should be the overall course you have laid out and the general outcomes.

Your Detailed report brings together all of the other reports in the system with commentary and more. This downloadable report is a great way to get into the details of how your plans are set to unfold and compare past projections to where you are now.

Revise, Update, Re-Evaluate

Continue to engage in the three areas. Some sets of choices will lead to an Assessment that works on the first try, others will require you to modify your thinking. Good or bad, better or worse is all a matter of perspective. in the end, it is your life, so the only perspective that matters is yours.

Traditionally, financial plans have always been constructed with the goal of saving a set amount of money to allow for a single repetitive future spend level or to create the largest possible estate. Our goal is to help you build plans that help you live the life you desire.