Stress Less About MoneyOver 70% of Canadians say they are worried about their financial future. Of those, 42% rank money as their greatest stressor while 50% are embarrassed to talk about it and 40% of couples argue over it. Yet, most people hate the idea of financial planning (and less than 30% of Canadians currently have a plan in place). Why? Because traditional planning has a well-deserved reputation for being more tedious, time-consuming and overwhelming than it’s worth. The cost of financial advice can be exorbitant and the recommendations are almost always the same. Spend less. Save more. Work longer. (Which only increases the stress you’re already feeling.) |  |

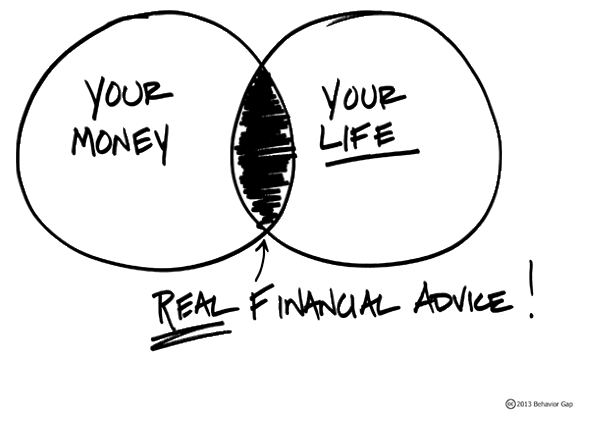

We have revolutionized the planning experienceBetter Money Choices puts the focus on the life you want to live, not how much you need to save for a goal as vague as retirement. We all want to retire, but what do you want that retirement life to look like? What is actually possible? These are the questions the matter. With acces to tools that offer real-time feedback on where you choices are leading, your plan is all about the things which matter most to you. | |

What makes us so different? | |

There are a lot of budgeting apps and personal finance tools out there. The majority seem to be obsessed with lecturing you on how to eliminate ‘so-called’ wasteful spending. We believe your time and energy will be much better spent concentrating on making Better Money Choices™ going forward, instead of looking backward in regret at what you’ve spent your money on in the past. Focusing on your big, life-defining financial choices – and the trade-offs that may be needed to achieve them – will reap far greater rewards than looking for small, incremental savings from cutting back on little things like lattes. After all, your most valuable asset isn’t money. It’s time – and how you choose to spend it. Spend it well, and you’ll have far fewer regrets. Being in control of your finances is the ultimate stress reliever. |  |